India has emerged as the second-largest steel producer in the world, with production surpassing 135 million tonnes in FY25. The growth has been driven by resource-rich states, government policies, and demand from infrastructure, automobiles, and construction.

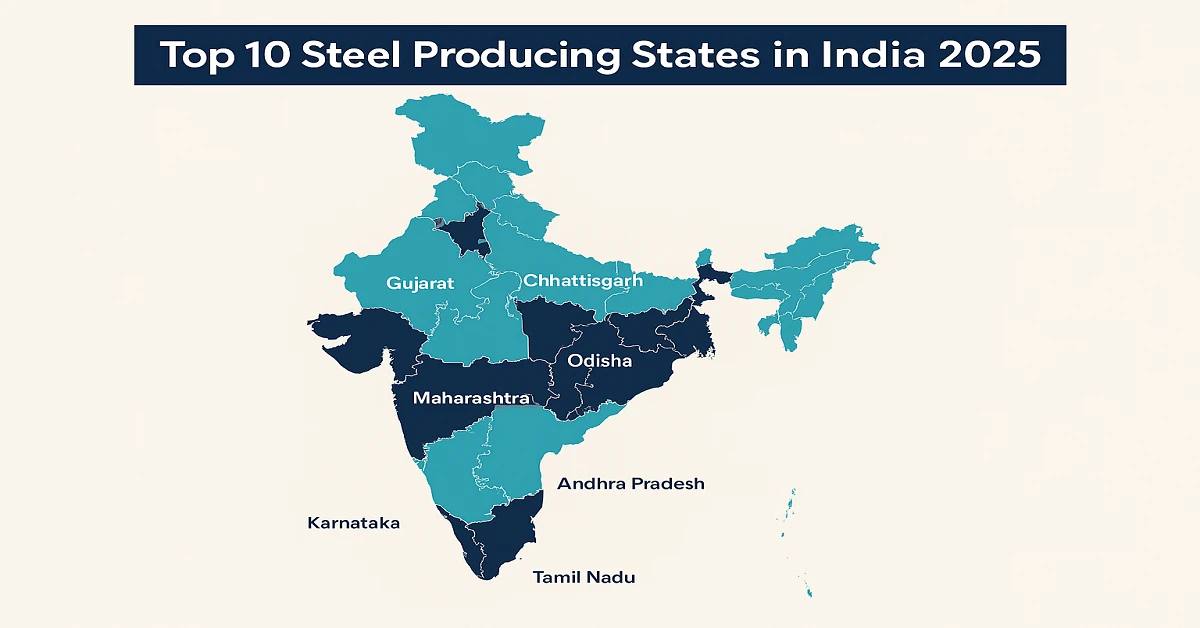

This article explores the Top 10 Steel Producing States in India 2025, their output, key companies, and their role in making India a global steel hub.

Introduction: Why State-Wise Steel Production Matters

The Top 10 Steel Producing States in India 2025 reveal the distribution of production capacity, resources, and industry clusters across the nation. India’s steel consumption is projected to grow 9–10% annually, fueled by housing, infrastructure, and manufacturing expansion.

Steel-producing states such as Odisha, Chhattisgarh, and Jharkhand account for more than 60% of total output, reflecting their mineral wealth and industrial infrastructure.

Top 10 Steel Producing States in India 2025

Odisha – India’s Steel Powerhouse

- Production Capacity: ~40 million tonnes annually

- Major Players: Tata Steel, Jindal Steel & Power, JSW Steel

- Key Advantage: Rich in iron ore reserves, well-connected ports like Paradip for exports.

Odisha contributes over 30% of India’s crude steel output, making it the undisputed leader.

Chhattisgarh – The Rising Steel Giant

- Production Capacity: ~25 million tonnes annually

- Major Players: SAIL’s Bhilai Steel Plant, Jindal Steel & Power

- Key Advantage: Abundant coal reserves and central location for logistics.

Bhilai Steel Plant is one of India’s oldest and largest, producing rails and structural steel for infrastructure.

Jharkhand – Resource-Rich and Industrially Strong

- Production Capacity: ~20 million tonnes annually

- Major Players: Tata Steel (Jamshedpur), SAIL (Bokaro Steel Plant)

- Key Advantage: High-grade iron ore and coking coal reserves.

Jamshedpur remains India’s first and most iconic steel city.

Karnataka – A Southern Steel Hub

- Production Capacity: ~18 million tonnes annually

- Major Players: JSW Steel (Vijayanagar plant, world’s largest single-location steel plant)

- Key Advantage: Strong logistics and proximity to southern markets.

JSW Vijayanagar plant alone accounts for 12 million tonnes of output annually.

Maharashtra – Balancing Industry and Demand

- Production Capacity: ~15 million tonnes annually

- Major Players: Essar Steel (ArcelorMittal Nippon Steel India), private sector rolling mills

- Key Advantage: Coastal access for imports and exports.

Steel demand here is driven by Mumbai’s real estate and auto industries.

West Bengal – Traditional Steel Backbone

- Production Capacity: ~12 million tonnes annually

- Major Players: Durgapur Steel Plant, IISCO Steel Plant, private units

- Key Advantage: Eastern coal belt and historical industrial base.

A key supplier for railways and engineering industries.

Gujarat – Coastal Advantage in Steel Production

- Production Capacity: ~11 million tonnes annually

- Major Players: ArcelorMittal Nippon Steel India (Hazira plant)

- Key Advantage: Strong port infrastructure (Hazira, Mundra).

Gujarat’s steel caters heavily to shipbuilding, pipelines, and exports.

Andhra Pradesh – Expanding Steel Frontier

- Production Capacity: ~9 million tonnes annually

- Major Players: Rashtriya Ispat Nigam Limited (Vizag Steel Plant)

- Key Advantage: Port-led growth with strategic location on east coast.

Vizag Steel exports to Southeast Asia and Middle East markets.

Tamil Nadu – Focus on Stainless Steel and Alloys

- Production Capacity: ~7 million tonnes annually

- Major Players: Salem Steel Plant (SAIL), private sector stainless steel makers

- Key Advantage: Strong demand from automotive and manufacturing hubs.

Supplies to India’s auto corridor in Chennai, Hosur, and Coimbatore.

Punjab – Northern India’s Steel Supplier

- Production Capacity: ~6 million tonnes annually

- Major Players: Local rolling mills, secondary steel units

- Key Advantage: Demand from construction and agriculture equipment industries.

Plays a key role in meeting regional rebar and pipe demand.

India’s Steel Sector in 2025: Key Trends

- Green Steel Transition – India invests in hydrogen-based steel production.

- Rising Consumption – India’s per capita steel use crosses 85 kg, still below global average of 230 kg.

- Government Support – National Steel Policy 2017 targets 300 million tonnes capacity by 2030.

- Exports Growth – India’s steel exports rose 15% YoY in FY25.

Economic Impact

- Jobs: The steel industry directly employs over 2.5 million people in these states.

- GDP Contribution: Contributes nearly 2% of India’s GDP.

- Regional Development: States like Odisha and Chhattisgarh benefit from infrastructure-led industrialization.

Frequently Asked Questions (FAQ)

Q1: Which state produces the most steel in India in 2025?

Odisha, with around 40 million tonnes annually.

Q2: Which is India’s largest steel plant?

JSW Steel’s Vijayanagar plant in Karnataka.

Q3: How much steel does India produce in 2025?

Over 135 million tonnes annually, making it the world’s second-largest producer.

Q4: What drives steel demand in India?

Infrastructure, housing, construction, and automobiles.

Q5: Which states are emerging steel hubs?

Andhra Pradesh and Gujarat are rapidly expanding.

Conclusion

The Top 10 Steel Producing States in India 2025 reflect a strong and diverse industrial base. With Odisha, Chhattisgarh, and Jharkhand leading, and states like Gujarat and Andhra Pradesh emerging, India is on track to meet its steel capacity goals.

Steel remains at the heart of India’s Make in India and Atmanirbhar Bharat initiatives, powering growth across industries and positioning India as a global leader in sustainable steel production.